Navigating the world of startup funding: your path to money.

Welcome to the venturetrend newsletter 🥞

Startups are coming in hot.

753,168 new companies were set up in the UK between March 2021 - March 2022. And the first 3 months of this year, there were 202,130 new businesses set up.

If we take it cross-Atlantic, U.S. stats actually show 5m+ new businesses started in 2022. Competition is higher than ever.

…and startup funding is scarce, slow & fragmented.

According to PitchBook data, global VC firms were sitting on $585.5 billion of capital raised but not allocated as of the end of Q3 2022.

It’s not always clear how fast they invest this money.

In normal times, historical data is generally a good indicator of what to expect. But we’re in abnormal times, and there’s plenty of contradicting evidence on what’s happening (recession? AI bubble? Early signs of recovery? IPOs nowhere near the horizon?)

In an extreme example, Tiger Global closed a $12.7 billion VC fund in March 2022 and had invested nearly all of that money in 2 months. The results? The fund suffered a paper loss of 20%, net of management fees 📉📉📉

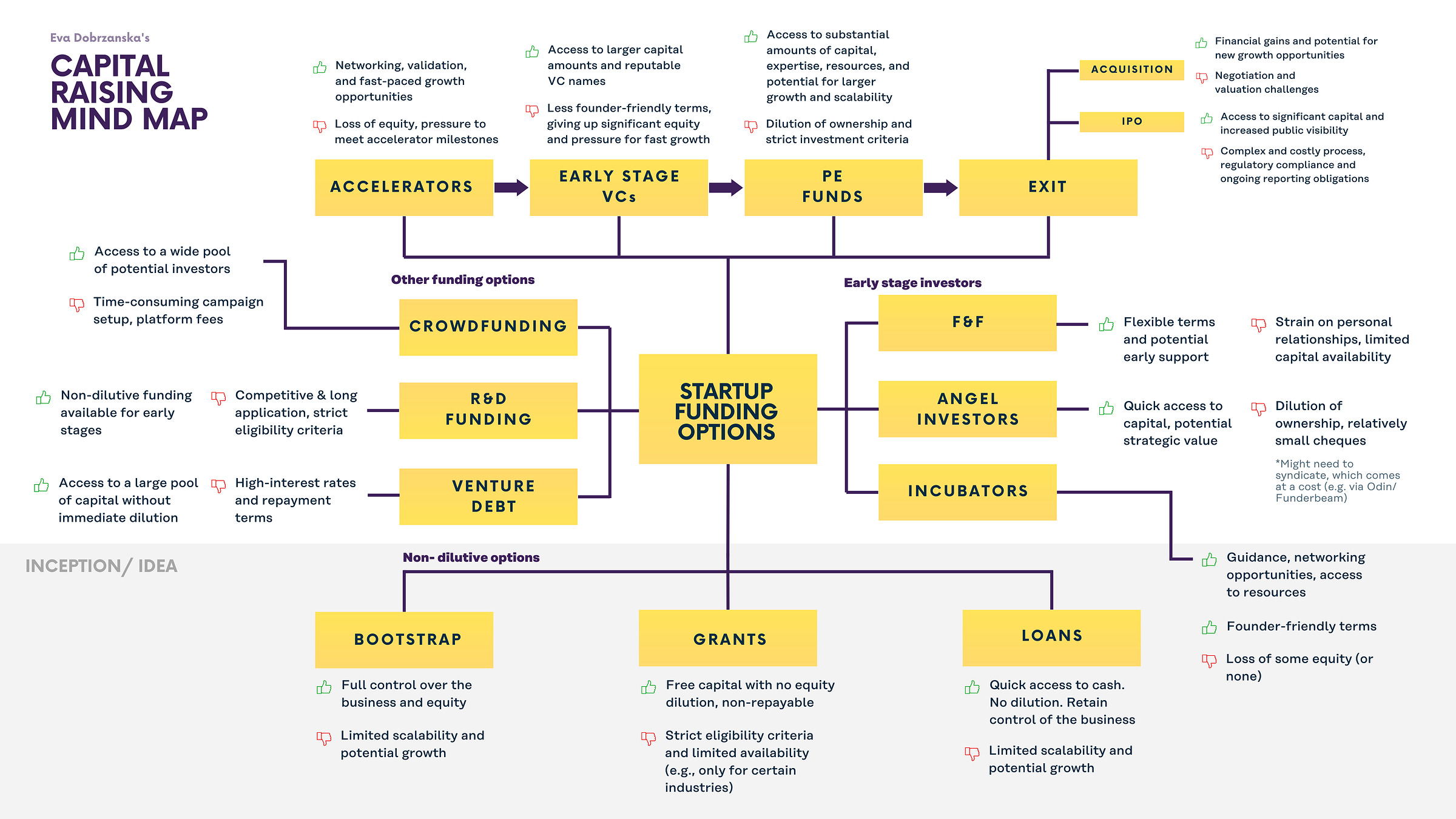

Luckily, as a startup founder, you’ve got options:

Bootstrapping

bootstrapping = practice of starting and growing a business without external funding or investment. In a bootstrapped startup, the founders rely on their personal savings, revenue generated by the business, and minimal resources to fund the company's operations and growth.A lot of Founders choose to bootstrap the idea with savings or income from full-time/ part-time employment they still remain in. Many founders I know said they would quit their jobs upon receiving their first significant cheque into the business (~ 100k+).

To some investors, this can be somewhat a red flag, and they would ask, “So how much time are you actually devoting to your business, and how much to employment? Does your IP fully belong to you?” 🚩

The main advantage of this approach is that you retain 100% ownership of the equity in your business. Jason Fried’s Basecamp is entirely self-funded. They used their own revenue to fund the company’s growth, kept the team small, and focused on lean operations.

“Run on limited resources and you’ll be forced to reckon with constraints earlier and more intensely. And that’s a good thing. Constraints drive innovation.”

Friends & Family, Angel Investors

I speak with founders on a regular basis. The question I always make sure to ask is, “What are your current challenges in raising capital?”

Limited networks and balancing the business-fundraising balance are the two most common ones. This is why many founders will find their first injection of money in Friends, Family, or Angel Investors.

They write relatively smaller cheques (compared to funds) and should be syndicated under an SPV, so that each one of their investments is consolidated into 1 single entry line on your cap table.

Incubators + Accelerators

Incubators and accelerators provide fantastic value especially for first-time and/or solo founders as they will extend a web of support around you and access to a network.

There are a couple of slight differences between them.

🌱 Incubators:

They cater to the needs of startups earlier in the growth journey than accelerators (usually, idea/ concept, with no product yet), and offer a broader range of services.

The program is likely to be structured to offer a guiding hand to founders. They can provide funding as well.

At Block Dojo, we run a 3 month long face-to-face program for idea-stage founders building on Blockchain. We invest £10k in each and help them validate the idea, gather early feedback, and then build a prototype/MVP alongside their first Pre Seed pitch deck and financial forecasts to take to first investors (usually, Angels and SEIS funds).

🌿 Accelerators

Ideal for startups ready for growth, usually with an MVP or a working prototype, or post-launch, with a narrower focus on product development & growth. These programs are likely to be more bespoke, depending on the startup’s stage and needs.

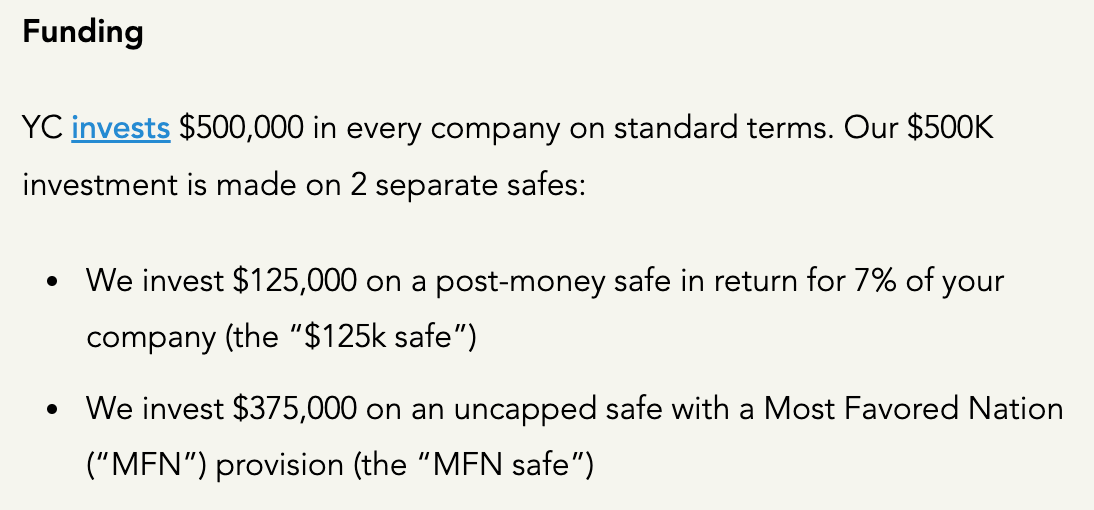

They usually provide funding as well, which can be substantial, and so the applications are more competitive. The most famous one, YC, offers the following:

Crowdfunding

Crowdfunding is another option to consider. Gagan Biyani’s Maven opened a crowdfunding campaign to allow non-accredited investors and their potential customers to invest in small cheque sizes. Just a year later, the company raised $20 million in a Series A round led by Andreessen Horowitz.

Corporate Venture Capital

Corporate Venture Capital (CVC) - form of venture finance where corporations are directly investing into private companies, often strategically, to gain competitive advantage and access to new markets.Some of the most active corporate venturing arms in the UK include UK Steel Enterprise (cheque sizes between £25k - £1m), Google Ventures (invest between $2m and $30m), Unilever Ventures, and BP Ventures.

CVCs often bring industry-specific knowledge and experience to the table and can provide startups with access to resources and expertise (customer introductions, distribution channels, etc.), for example:

Intel Capital invested $15m into MongoDB in 2013 which came with a strategic collaboration between the two companies. MongoDB optimized its database platform for Intel architecture, and Intel provided technical expertise and resources.

The downside is that CVCs often invest only on the basis of close strategic fit, so in your outreach to them, be prepared to talk through the specifics of how you could collaborate. Also, CVCs might have an influence on important decisions, potentially limiting the startup's autonomy and flexibility in pursuing its own vision.

Family Offices

Somewhat elusive and characterized by a more traditional approach (read: long-term relationship-building), Family Offices’ funding is one that founders find challenging to secure. Nonetheless, they are becoming increasingly more prominent in the investment scene.

The modern concept of the family office goes back to the 19th century when JP Morgan founded the House of Morgan to manage his family assets. 1882-founded Rockefeller Capital Management oversees ~ $100 billion in client assets, and recently sold a 20.5% stake for $622m.

According to EY, the number of family offices increased ten-fold since 2008, and now stands at around 10,000.

“Today, hundreds of multi-family offices are being created all over the world; the trend has extended from multi-generational wealth in the West to now cover Latin America, the Middle East, and Asia.”

Culture and wealth structures also shape the extent to which heads of family delegate investment decisions, build their asset class portfolios, and perceive the importance of philanthropic work.

Family Offices is one of the topics I am keen to research and I’ll be diving in deeper into this topic in one of the next newsletters!

Subscribe below 👇